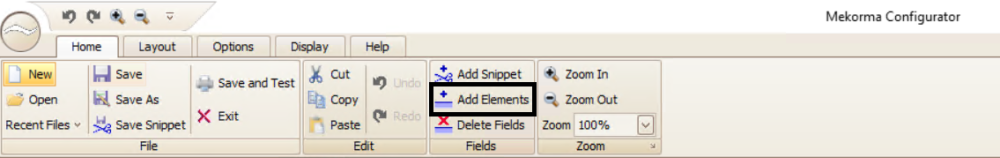

All available check stub fields within the Mekorma Configurator are listed below by section. Any of these fields can be added by clicking on the Add Elements button once the Mekorma Configurator has been opened:

These fields are available for Payables, US Payroll and Canadian Payroll check stubs:

- General Information

-

- Approver 1

- Approver 2

- Bank Account Number

- Bank Address

- Bank Branch

- Bank Fax Number

- Bank ID

- Bank Master Transit Number

- Bank Name

- Bank Phone 1

- Bank Phone 2

- Bank Phone 3

- Check Comment 1

- Check Comment 2

- Check Comment 3

- Checkbook Description

- Checkbook ID

- CM User Defined 1

- CM User Defined 2

- Company Address

- Company Contact

- Company Fax Number

- Company Location Name

- Company Name

- Company Phone 1

- Company Phone 2

- Company Phone 3

- GL Posting Date

- Printed By

- Requester

- Transit Number

- User ID

- AMOUNT

- Amount

- Canadian Funds

- Check Date

- CHECK NO

- Cheque Date

- CHEQUE NO

- Date

- DATE

- DDMMYYYY

- Description

- Description Reference

- Discount Taken

- Dollars

- GL Account Number

- Invoice Date

- Invoice Number

- MMDDYYYY

- Net Check Amt

- Net Cheque Amt

- Net Paid Amount

- Net Paid Amt

- ORDER OF

- Outstanding Amt

- Paid Amount

- Pay

- PAY

- Pay to the Order of

- Payee

- Payment Number

- PO Number

- TO THE

- to the Order of

- US Funds

- Voucher Amount

- Voucher Number

- Write Off

- YYYYMMDD

Logical Fields

- EFT Comment

- EFT Logo

- EFT Non-Negotiable

- EFT VOID

- Facility Signature 1

- Facility Signature 2

- Line 1

- Line 2

- Continued

- Signature File 1

- Signature File 2

- Signature File 1 Based on PO Number

- Signature File 2 Based on PO Number

- Signature Line 1 Based on PO Number

- Signature Line 2 Based on PO Number

Payables

- Detailed Addresses for Payables

-

- Bank Address 1

- Bank Address 2

- Bank Address 3

- Bank City-State-Zip

- Bank Country

- Company Address 1

- Company Address 2

- Company Address 3

- Company City-State-Zip

- Company Country

- Payment Address 1

- Payment Address 2

- Payment Address 3

- Payment Address ID

- Payment City-State-Zip

- Payment Contact

- Payment Country

- Payment Zip

- Vendor Main Address 1

- Vendor Main Address 2

- Vendor Main Address 3

- Vendor Main City-State-Zip

- Vendor Main Country

- 1099 Amount

- Account Alias

- Account Description

- Account Number

- Account User Defined 1

- Account User Defined 2

- Credit Amount

- Debit Amount

- Distribution Reference

- Document Type

- Enhanced Net Check Amount

- Freight Amount

- Intercompany ID

- Misc Charges Amount

- Multi-Currency Debit Minus Credit Amount

- New Amount Paid (Tech Knowledge 18381)

- New Document Amount (Tech Knowledge 18381)

- Originating Credit Amount

- Originating Debit Amount

- Payment Terms ID

- Posting Date

- Purchase Order Number

- Purchases Amount

- Shipping Method

- Tax Amount

- Tax Schedule ID

- Trade Discount Amount

- TRX Source

- Voucher Amount Paid

- Voucher Credit Amount

- Voucher Credit Document Amount

- Voucher Discount Date

- Voucher Discount Taken Amount

- Voucher Discount Taken Total

- Voucher Document Amount

- Voucher Document Date

- Voucher Document Number

- Voucher GST Discount Amount

- Voucher Net Check Amount

- Voucher Net Paid Amount

- Voucher Outstanding Amount

- Voucher Paid Total

- Voucher PPS Amount Deducted

- Voucher Total Document Amount

- Voucher Transaction Description

- Voucher Voucher Number

- Voucher Write Off Amount

- Voucher Write Off Total

MEM Centralized (only available with MEM Connector, sold separately)

- Facility ID

- Facility Name

- Facility Company Name

- Document Number

- Transaction Description

- Discount Taken Amount

- Purchase Order Number

- Net Paid Amount

- New Amount Paid (Tech Knowledge 18381)

- Document Date

- Voucher Number

- Voucher Date

- Document Amount

- Internet User Defined 1

- Internet User Defined 2

MEM Decentralized (only available with MEM Connector, sold separately)

- Facility ID

- Facility Name

- Facility Company Name

- Facility Address

- Internet User Defined 1

- Internet User Defined 2

Payment

- Amount in Words

- Amount in Words with Word Wrapping

- Amount in Words (Techknowledge 857824)

- Amount in Words (Techknowledge 857824) with Word Wrapping

- Check Comment

- Check Amount with ***

- Check Number

- Check Total

- Document Date

- Document Date-D1

- Document Date-D2

- Document Date-M1

- Document Date-M2

- Document Date-Y1

- Document Date-Y2

- Document Date-Y3

- Document Date-Y4

- EFT or Regular Check Total

- Payment Comment (from Edit Payables Checks)

- Payment Number

POP Single Line Per Invoice

- 1099 Amount

- Amount Paid

- Credit Amount

- Credit Document Amount

- Discount Date

- Discount Taken Amount

- Discount Taken Total

- Document Amount

- Document Date

- Document Number

- Document Type

- Due Date

- Enhanced Net Check Amount

- Freight Amount

- GST Discount Amount

- Misc Charges Amount

- Net Check Amount

- Net Paid Amount

- New Amount Paid (Tech Knowledge 18381)

- New Document Amount (Tech Knowledge 18381)

- Outstanding Amount

- Paid Total

- Payment Terms ID

- POP Extended Cost

- POP Item Description

- POP Item Description or Voucher Description

- POP Item Number

- POP or Voucher PO Number

- POP QTY Invoiced

- POP Receipt Date or Voucher Date

- POP Receipt Number or Voucher Number

- POP Reference or Voucher Description

- POP Unit Cost

- POP Unit of Measure

- POP Vendor Document Number

- Posting Date

- PPS Amount Deducted

- Project Contract Name

- Project Contract Customer

- Project Contract Number

- Project Contract ID

- Project Cost

- Project Customer Number

- Project Number

- Project Purchase Order Number

- Project User Defined1 Contract

- Project User Defined2 Contract

- Purchase Order Number

- Purchases Amount

- Shipping Method

- Tax Amount

- Tax Schedule ID

- Total Document Amount

- Trade Discount Amount

- Transaction Description

- TRX Source

- UD Date01

- UD Date02

- UD Date03

- UD Date04

- UD Date05

- UD Date06

- UD Date07

- UD Date08

- UD Date09

- UD Date10

- UD Date11

- UD Date12

- UD Date13

- UD Date14

- UD Date15

- UD Date16

- UD Date17

- UD Date18

- UD Date19

- UD Date20

- UD List01

- UD List02

- UD List03

- UD List04

- UD List05

- UD Text01

- UD Text02

- UD Text03

- UD Text04

- UD Text05

- UD Text06

- UD Text07

- UD Text08

- UD Text09

- UD Text10

- Voucher Number

- Write Off Amount

- Write Off Total

POP Multiple Lines Per Invoice

- 1099 Amount

- Amount Paid

- Credit Amount

- Credit Document Amount

- Discount Date

- Discount Taken Amount

- Discount Taken Total

- Document Amount

- Document Date

- Document Number

- Document Type

- Due Date

- Enhanced Net Check Amount

- Freight Amount

- GST Discount Amount

- Misc Charges Amount

- Net Check Amount

- Net Paid Amount

- New Amount Paid (Tech Knowledge 18381)

- New Document Amount (Tech Knowledge 18381)

- Outstanding Amount

- Paid Total

- Payment Terms ID

- POP Extended Cost

- POP Item Description

- POP Item Description or Voucher Description

- POP Item Number

- POP or Voucher PO Number

- POP QTY Invoiced

- POP Receipt Date or Voucher Date

- POP Receipt Number or Voucher Number

- POP Reference or Voucher Description

- POP Unit Cost

- POP Unit of Measure

- POP Vendor Document Number

- Posting Date

- PPS Amount Deducted

- Project Contract Name

- Project Contract Customer

- Project Contract Number

- Project Contract ID

- Project Cost

- Project Customer Number

- Project Number

- Project Purchase Order Number

- Project User Defined1 Contract

- Project User Defined2 Contract

- Purchase Order Number

- Purchases Amount

- Shipping Method

- Tax Amount

- Tax Schedule ID

- Total Document Amount

- Trade Discount Amount

- Transaction Description

- TRX Source

- UD Date01

- UD Date02

- UD Date03

- UD Date04

- UD Date05

- UD Date06

- UD Date07

- UD Date08

- UD Date09

- UD Date10

- UD Date11

- UD Date12

- UD Date13

- UD Date14

- UD Date15

- UD Date16

- UD Date17

- UD Date18

- UD Date19

- UD Date20

- UD List01

- UD List02

- UD List03

- UD List04

- UD List05

- UD Text01

- UD Text02

- UD Text03

- UD Text04

- UD Text05

- UD Text06

- UD Text07

- UD Text08

- UD Text09

- UD Text10

- Voucher Number

- Write Off Amount

- Write Off Total

UK Cheques

- UK Cheque Amount

- UK Vendor Name Only

- UK Vendor Name*

- UK Vendor Name

- UK Document Date

- UK Amount in Words with Word Wrapping

Vendor

- 1099 Amount YTD

- 1099 Type

- Account Number With Vendor

- Account Type

- Bank Account Number

- Bank Name

- Bank Transit Number

- Contact Name

- Fax Number

- Governmental Corporate ID

- Governmental Individual ID

- Parent Vendor ID

- Payment Address

- Payment Address with Country

- Payment Priority

- Payment Terms ID

- Phone 3

- Phone Number 1

- Phone Number 2

- Shipping Method

- Tax ID Number

- Tax Registration Number

- Vendor Address with Contact Name

- Vendor Check Name

- Vendor Check Name – SAFE PAY

- Vendor Class ID

- Vendor Comment 1

- Vendor Comment 2

- Vendor Contact

- Vendor ID

- Vendor Main Address

- Vendor Name

- Vendor Name – SAFE PAY

- Vendor Note

- Vendor Short Name

- Vendor User Defined 1

- Vendor User Defined 2

Voucher

- 1099 Amount

- Amount Paid

- Credit Amount

- Credit Document Amount

- Discount Date

- Discount Taken Amount

- Discount Taken Total

- Document Amount

- Document Date

- Document Number

- Document Type

- Due Date

- Enhanced Net Check Amount

- Freight Amount

- GST Discount Amount

- Misc Charges Amount

- Net Check Amount

- Net Paid Amount

- New Amount Paid (Tech Knowledge 18381)

- New Document Amount (Tech Knowledge 18381)

- Outstanding Amount

- Paid Total

- Payment Terms ID

- Posting Date

- PPS Amount Deducted

- Purchase Order Number

- Purchases Amount

- Shipping Method

- Tax Amount

- Tax Schedule ID

- Total Document Amount

- Trade Discount Amount

- Transaction Description

- Transaction Long Description

- TRX Source

- Voucher Number

- Write Off Amount

- Write Off Total

Refund Single Document

- Document Amount

- Document Date

- Document Description

- Document Number

- Document Type

- Customer Name

- Customer Number

- Customer PO Number

- Extended Price

- Freight Amount

- Item Description

- Item Number

- Markdown Amount

- Misc Amount

- Quantity

- Salesperson ID

- Sales Territory

- Shipping Method

- Tax Amount

- Trade Discount Amount

- U Of M

- Unit Price

Refund Multiple Documents

- Document Amount

- Document Date

- Document Description

- Document Number

- Document Type

- Customer Name

- Customer Number

- Customer PO Number

- Misc Amount

- Salesperson ID

- Sales Territory

- Shipping Method

- Tax Amount

- Trade Discount Amount

US Payroll

- Benefits

-

- Benefit Amount Array

- Benefit Amount YTD Array

- Benefit Code Array

- Benefit Description

- Total Benefits

- Amount in Words

- Amount in Words with Word Wrapping

- Check Amount with ***

- Check Date

- Check Date-D1

- Check Date-D2

- Check Date-M1

- Check Date-M2

- Check Date-Y1

- Check Date-Y2

- Check Date-Y3

- Check Date-Y4

- Check Number

- Facility Name

- Facility Stub String

- Facility Check String

- Facility ID

- Facility Company Name

- Facility Address

- Internet User Defined 1

- Internet User Defined 2

- Net Wages Pay Run

- Check Direct Deposit Amount

Deductions

- Deduction Amount Array

- Deduction Amount YTD Array

- Deduction Code Array

- Deduction Description

- Total Deductions

Detailed Addresses

- Bank Address 1

- Bank Address 2

- Bank Address 3

- Bank City-State-Zip

- Bank Country

- Company Address 1

- Company Address 2

- Company Address 3

- Company City-State-Zip

- Company Country

- Employee Address 1

- Employee Address 2

- Employee Address 3

- Employee City-State-Zip

- Employee Country

- Employee Country Code

- Employee County

- Employee Fax

- Employee Foreign Postal Code

- Employee Foreign State Province

- Employee Phone 1

- Employee Phone 2

- Employee Phone 3

- Employee Zip

- First Name

- Last Name

- Middle Name

Direct Deposit

- DD Array12 Account Number

- DD Array12 Amount

- DD Array12 Transaction Code

- DD Array12 Transit Number

- DD Number of Accounts

- Net Wages Pay Run (Stub Only)

Earnings

- Business Expense Earnings

- Charged Tips Earnings

- Commission Earnings

- Double Time Earnings

- EIC Earnings

- Holiday Earnings

- Min Wage Bal Earnings

- Overtime Earnings

- Pension Earnings

- Piecework Earnings

- Piecework Units

- Regular Earnings

- Reported Tips Earnings

- Sick Time Earnings

- Special Earnings

- Total Earnings

- Vacation Earnings

Employee

- Alternate Name

- Class Description

- Department

- Department Additional Description

- Department Description

- Division Address 1

- Division Address 2

- Division City-State-Zip

- Division Code

- Division Name

- Employee Address

- Employee Class

- Employee Full Name – SAFE PAY

- Employee ID

- Employee Name

- Employee Name with Suffix

- Employee Note

- Employee Suffix

- Employee User Defined 1

- Employee User Defined 2

- Federal Classification Code

- First Name

- Job Title

- Job Title Description

- Last Name

- Location ID

- Middle Name

- NickName

- Rate Class

- Social Security Number

- Social Security Number-MASKED

- Supervisor Code

- Type of Employment

- Union Code

Federal Taxes

- Federal Additional Withholding

- Federal Filing Status

- Federal Withholding Exemptions

- Federal Withholding YTD

- Federal Withholding Pay Run

- FICA Withholding YTD

- FICA Medicare Withholding YTD

- FICA Medicare Withholding Pay Run

- FICA Social Security Withholding YTD

- FICA Social Security Withholding Pay Run

- Total FICA Tax Withheld

- Uncollected FICA Med Tax Pay Run

- Uncollected FICA SS Tax Pay Run

- Employer ID Number

Hours

- Days Worked YTD

- Double Time Hours

- Holiday Hours

- Hours Worked YTD

- Overtime Hours

- Regular Hours

- Sick Time Available

- Sick Time Hours

- Time Available Array

- Time Code Array

- Time Code Description Array

- Total Hours

- Vacation Available

- Vacation Hours

- Weeks Worked YTD

- Work Hours Per Year

Local Taxes

- Local Tax Array

- Local Tax Description

- Local Tax Withholding Array

- Local Tax YTD

- Local Withholding YTD

Pay Data

- Pay Code Array

- Pay Code Description

- Pay Earnings Array

- Pay Hours Array

- Pay Hours Array-Blank for Salary

- Pay Rate Array

- Pay Rate Array-Blank for Salary

- Pay Type Array

- Pay YTD Array

- Total YTD Pay Code Earnings

Pay Stub Information

- End Pay Period

- Federal Wages Pay Run

- Gross Wages YTD

- Gross Wages Pay Run

- Net Wages YTD

- Payment Adjustment Number

- Start Pay Period

- Total Taxes

- Total Taxes YTD

- User ID

State Taxes

- Additional Allowances

- State Additional Withholding

- State Filing Status

- State Name

- State Number of Dependents

- State Tax Array

- State Tax Withholding Array

- State Tax YTD

- State Withholding YTD

Tips

- Allocated Tips YTD

- Charged Receipts YTD

- Charged Tips YTD

- Federal Tax On Tips YTD

- Federal Tips YTD

- FICA Med Tax On Tips YTD

- FICA Med Tips YTD

- FICA SS Tax On Tips YTD

- FICA SS Tips YTD

- Reported Receipts YTD

- Reported Tips YTD

- Uncollected FICA Med Tax YTD

- Uncollected FICA SS Tax YTD

Canadian Payroll

- Detailed Addresses

- Bank Address 1

- Bank Address 2

- Bank Address 3

- Bank City-State-Zip

- Bank Country

- City

- Company Address 1

- Company Address 2

- Company Address 3

- Company City-State-Zip

- Company Country

- Country

- Employee Address 1

- Employee Address 2

- Employee City-Province-Postal Code

- First Name

- Last Name

- Middle Name

- Phone

- Postal Code

- Province

- Income Pay Code

- Income Description

- Income Rate

- Income Units

- Income Current $

- Income YTD Units

- Income YTD Dollars

Employee

- Address

- Birth Date

- City

- Class ID

- Country

- Department

- Employee ID

- First Name

- Full Name

- Last Name

- Middle Name

- Phone

- Position

- Postal Code

- Province

- SIN

- Start Date

- Taxable Province

- User Defined 1

- User Defined 2

- User ID

Payment Details

- Deduction Description

- Deduction Employee Share

- Deduction Employer Share

- Deduction Paycode

- Deduction Rate

- Deduction Taxable Benefit Amount

- Deduction Units

- Earnings Amount

- Earnings Dept

- Earnings Description

- Earnings Paycode

- Earnings Rate

- Earnings Transaction Date

- Earnings Units

Summary Advice

- Income Pay Code

- Income Description

- Income Rate

- Income Units

- Income Current $

- Income YTD Units

- Income YTD Dollars

- Benefit Pay Code

- Benefit Description

- Benefit Rate

- Benefit Units

- Benefit Current $

- Benefit YTD Units

- Benefit YTD Dollars

- Deduction Pay Code

- Deduction Description

- Deduction Rate

- Deduction Units

- Deduction Current $

- Deduction YTD Units

- Deduction YTD Dollars

Payment Summary

- Accumulated Days

- Accumulated Overtime Hours

- Accumulated Regular Hours

- Accumulated User1

- Accumulated User2

- Accumulated User3

- Accumulated User4

- Advance Amount Drawn

- Advance Amount Reclaim

- Arrears Amount Created

- Arrears Amount Reclaim

- Batch Number

- Bonus Income

- Cheque Amount with ***

- Cheque Date

- Cheque Date-D1

- Cheque Date-D2

- Cheque Date-M1

- Cheque Date-M2

- Cheque Date-Y1

- Cheque Date-Y2

- Cheque Date-Y3

- Cheque Date-Y4

- Cheque Number

- End Date

- Net Pay

- Net Pay Words

- Net Pay Words Numbers

- Overtime Income

- Payment Method

- Regular Income

- Retroactive Income

- Start Date

- Total Withholdings

Vacation

- Accrual Amount

- Accrual Units

- Accrual Unpaid Units

- Accruing Amount

- Accruing Available After Date

- Accruing Units

- Accruing Unpaid Units

- Available Amount

- Available Payout After Date

- Available Units

- Available Unpaid Units

- Opening Balance

- YTD Accrued Vacation

YTD Tax Return

- Basic Personal Amount – AB

- Basic Personal Amount – BC

- Basic Personal Amount – Federal

- Basic Personal Amount – MB

- Basic Personal Amount – NB

- Basic Personal Amount – NL

- Basic Personal Amount – NS

- Basic Personal Amount – NT

- Basic Personal Amount – NU

- Basic Personal Amount – ON

- Basic Personal Amount – PE

- Basic Personal Amount – SK

- Basic Personal Amount – YT

- CPP Deducted 16

- CPP Pensionable 26

- EI Deducted 18

- EI Insurable 24

- Employment Income 14

- Income Tax Deducted 22

- Quebec TP-1015.3-V Base

- Registered Pension 20

- Taxable Benefits

- Taxable Income

Last modified:

April 28, 2022

Need more help with this?

We value your input. Let us know which features you want to see in our products.