Mekorma and your payment outsource provider will handle the initial implementation and configuration of the ePayment connector in Dynamics GP.

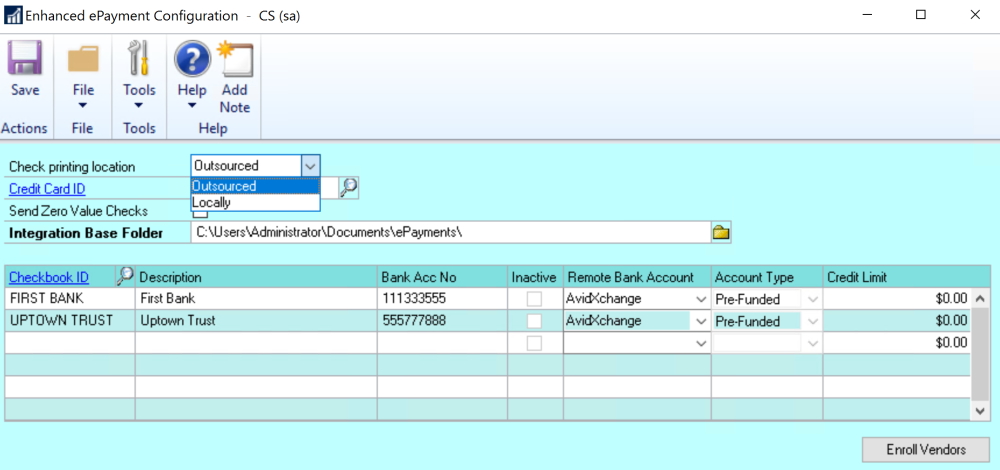

Enhanced ePayment Configuration

Once Table Maintenance has been run in a given company, the Enhanced ePayment Configuration window defines how that particular company is configured for payment outsourcing.

- The Check printing location field determines whether your payments are processed with the ePayment service (Outsourced), or printed and processed in-house (Locally).

- The Credit Card ID field is only required when the ePayment connector supports bulk funding (Nvoicepay customers only)- meaning a set of GP payments are funded with a single withdrawal from the client’s bank account (see below).

- The Integration base folder is configured to store the files sent to and received from the outsource provider. The system will automatically create the following subfolders if they do not exist:

- OutPayments: Will store payment files sent to the outsource provider

- InPayments: Will store processed payment (response) files received from the outsource provider

- All checkbooks that have been configured for outsourcing are listed in the Checkbook ID area. You will see the following information:

- Checkbook ID and description

- Bank account number as configured in Dynamics GP

- Remote Bank Account: This field lists the name of your outsource provider (AvidXchange or Nvoicepay)

- Account Type: Displays whether the checkbook is configured using the pre-funded or credit model; this refers to the method the outsource provider uses to fund your vendor payments. Only a pre-funded model is currently available – this means the outsource provider will withdraw funds from your company’s bank account before generating and sending payments to vendors.

How to fund your outsourced payments?

Before the outsource provider can send payment to your vendors, they will withdraw the funds to cover the full amount of the payments. There are two ways this can be done:

- Individual funding: Every GP payment corresponds to a withdrawal from your company’s checkbook. The withdrawals are treated like checks and each individual payment clears the checkbook.

- Bulk funding: A set of payments are funded by a single withdrawal from your company’s checkbook. From an accounting standpoint, those payments can be treated as credit card payments. Your vendors are being paid by a 3rd party (the outsource provider) – the outsource provider is reimbursed in a single, separate, payment; only that one payment clears the checkbook.

AvidXchange customers: Individual option only

Nvoicepay customers: Individual and Bulk available

Need more help with this?

We value your input. Let us know which features you want to see in our products.