Mekorma and your payment outsource provider will handle the initial implementation and configuration of the Remote Payment connector in Dynamics GP. This is necessary as Mekorma needs to implement and test the authentication to the provider’s portal. However, once the system is up and running, you should be able to apply updates yourself.

Watch this video for a quick overview of how Remote Payment Services for GP works.

If you’re using Corpay, the existing fields Customer Account and Invoice Comments are customizable. Data in GP tables can be mapped to these two fields and printed on Corpay remittance. A customized function is needed to support the mapping. Please reach out Mekorma Customer Success team at support@mekorma.com to discuss your needs.

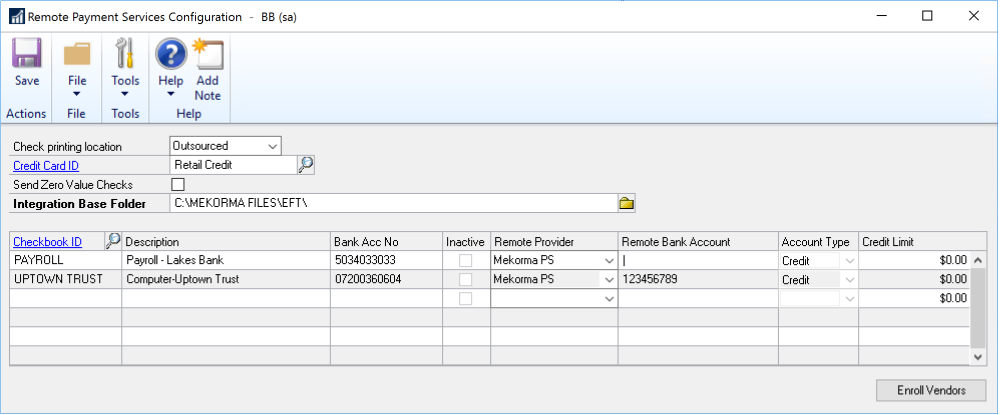

Remote Payment Services Configuration

Once Table Maintenance has been run in a given company, the Remote Payment Services Configuration window defines how that particular company is configured for payment outsourcing.

- The Check printing location field determines whether your payments are processed with the Remote Payment service (Outsourced), or printed and processed in-house (Locally).

- The Integration base folder is configured to store the files sent to and received from the outsource provider. The system will automatically create the following subfolders if they do not exist:

- OutPayments: Will store payment files sent to the outsource provider

- InPayments: Will store processed payment (response) files received from the outsource provider

- All checkbooks that have been configured for outsourcing are listed in the Checkbook ID area. You will see the following information:

- Checkbook ID and Description

- Bank Acc No as configured in Dynamics GP

- Remote Provider and Remote Bank Account: These field lists the name of your outsource provider and the funding method. See below for more information about funding methods.

- Account Type: Displays whether the checkbook is configured using the pre-funded or credit model; this refers to the method the outsource provider uses to fund your vendor payments. Only a pre-funded model is currently available – this means the outsource provider will withdraw funds from your company’s bank account before generating and sending payments to vendors.

Choosing a Funding Method

Before the outsource provider can send payment to your vendors, they will withdraw the funds to cover the full amount of the payments.

- Transaction funding: We recommend this method, where every GP payment corresponds to a withdrawal from your company’s checkbook. The withdrawals are treated like checks and each individual payment clears the checkbook.

- Bulk funding: All payments for the day for each checkbook are funded by a single withdrawal. Bulk Funding simplifies the number of banking transactions for funding. This can reduce costs and benefit your reconciliation processes. However, this method creates some complexity in the AP setup by using a pseudo Credit Card vendor as a holding tank to net out those funding transactions. When you first implement, our implementation team will work with you to determine the best funding method for your situation.

Corpay customers: Choose Corpay.

AvidXchange customers: Transaction Funding is the only Funding method so no choices will show.

Need more help with this?

We value your input. Let us know which features you want to see in our products.