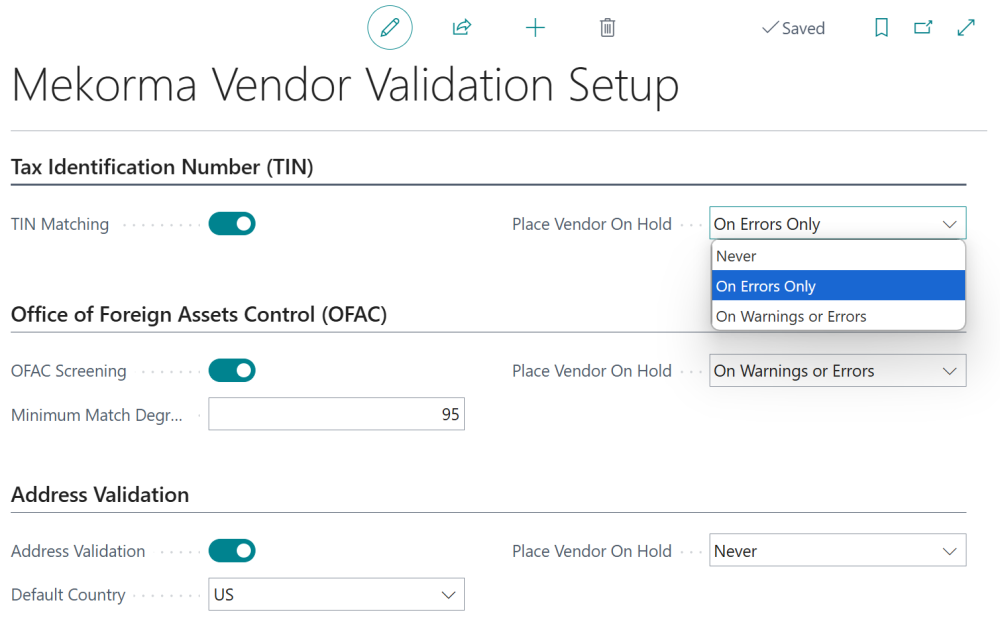

The Mekorma Vendor Validation Setup page is where you enable, disable, and configure each validation provider. By default, each provider is disabled. Click the toggle button to activate the providers you wish to use. When a provider is disabled, its configurations are noneditable. Configurations are per company; these settings must be set up for each company you use.

The Mekorma Vendor Validation Setup page is only accessible with admin access.

Universal Configurations

While most of the configurations vary for each provider, some apply to all validation services.

The enable/disable button. Use this to turn each provider on or off.

Block Vendor for Payment is where you dictate when to block a vendor from payments. When a vendor is blocked, payments are held from going through until any issue is solved. There are three options for blocking a vendor from payment:

- Never: The vendor will never be blocked for payment regardless of the validation result. When set to Never, the vendor status will not be altered by running a validation.

- On Errors Only: The vendor’s payment will be blocked only if the validation results in an error.

- On Warnings and Errors: The vendor’s payment will be blocked if the validation results in either a warning or an error.

The rest of the configurations vary for each provider, expand the topics below for more detailed information on that provider’s configurations:

- TIN Matching

-

Taxpayer Identification Number (TIN) Matching verifies the information in the Name and Tax Registration No. fields of the vendor card with the Internal Revenue Service (IRS). TIN Matching only validates vendors with a US-based address.

Block Vendor for Payment: Select when to block a vendor from payments. When the validation returns the status selected (i.e., it finds a warning or an error), the vendor is blocked, and payments will not be processed. If no warnings or errors are found, the vendor will not be blocked.

This table explains the scenarios for when a vendor would be placed on hold:

Status Explanation OK The vendor name and tax ID used for validation are complete and matched with the IRS database. Warning The vendor name or tax ID used for validation is missing or there is punctuation in the vendor name or Tax ID field. Error The vendor name and tax ID used for validation are complete but cannot be found in the IRS database.

- OFAC Screening

-

Office of Foreign Assets Control (OFAC) Screening compares all possible vendor information with the sanctions list from the Department of Treasury’s website.

Block Vendor for Payment: Select when to block a vendor from payments. When the validation returns the status selected (i.e., it finds a warning or an error), the vendor is blocked, and payments will not be processed. If no warnings or errors are found, the vendor will not be blocked.

Minimum Match Degree: Select the level of sensitivity to determine a vendor match from the OFAC Sanctions List. The system default is 95%. This means that if up to 95% of the vendor information (name, addresses, contact information, phone number, and e-mail address) matches the OFAC list, a warning will be given. This is adjustable between 90-100%. If it is set higher than 100%, or lower than 90%, it automatically adjusts to 95%.

This table explains the statuses for OFAC Screening.

Status Explanation OK The vendor information (name and main address) sent for validation does not appear on the OFAC Sanctions List. Warning The vendor information sent for validation matches between 95-99%. You can change the percentage amount in the Minimum Match Degree field in the Mekorma Vendor Validation Setup page. Error The vendor information sent for validation matches 100%.

- Address Validation

-

Address Validation compares your vendor address information with Google Address Validation.

Block Vendor for Payment: Select when to block a vendor from payments. When the validation returns the status selected (i.e., it finds a warning or an error), the vendor is blocked, and payments will not be processed. If no warnings or errors are found, the vendor will not be blocked.

Default Country: Set the default country for any address that does not specify a country/region code in the vendor card.

This table explains the statuses for the address validation.

Status Explanation OK All vendor addresses (including address line, city, state, zip code, and country) are complete and found in the Google Address Validation. Warning All vendor addresses are only partially matched with the Google Address Validation or a missing part was inferred, and a good match was found. Error All vendor addresses are complete but could not be found in Google Address Validation due to inferred missing address components.

Need more help with this?

We value your input. Let us know which features you want to see in our products.